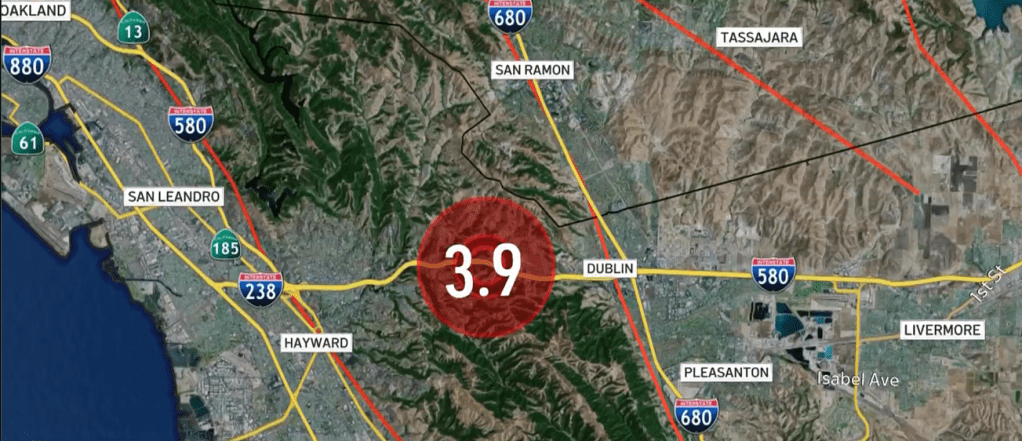

On March 17, 2025, a magnitude 3.9 earthquake struck near my town of Dublin, California, jolting residents across the San Francisco Bay Area. This event serves as a stark reminder of the region’s seismic activity and the importance of preparedness. Living in one of the most seismically active areas globally, Bay Area residents face the critical question: Is earthquake insurance necessary?

Understanding Earthquake Insurance

Earthquake insurance is a specialized policy designed to help homeowners, renters, and landlords recover financially from earthquake-induced damages. Standard property insurance policies typically do not cover earthquake damage, leaving individuals vulnerable to significant out-of-pocket expenses for repairs or rebuilding.

Coverage Details

A standard earthquake insurance policy generally includes:

- Dwelling Coverage: Assists in covering the cost of repairing or rebuilding your home if it’s damaged by an earthquake.

- Personal Property: Covers damage to personal belongings such as furniture and electronics resulting from seismic activity.

- Loss of Use (Additional Living Expenses): Pays for temporary housing and related expenses if your home becomes uninhabitable due to earthquake damage.

- Other Structures: Covers detached structures like garages or sheds, depending on the specific policy terms.

Exclusions to Be Aware Of

Even with earthquake insurance, certain exclusions apply:

- Fire Damage: Fires resulting from earthquakes are typically covered under standard homeowners insurance.

- Floods and Tsunamis: Damage from earthquake-triggered floods or tsunamis requires separate flood insurance coverage.

- Land Movement Not Directly Caused by an Earthquake: Events like landslides or sinkholes may not be covered unless directly linked to seismic activity.

Cost Considerations in the Bay Area

Premiums for earthquake insurance in the Bay Area are generally higher due to the region’s elevated seismic risk. Factors influencing the cost include:

- Proximity to Fault Lines: Homes closer to major fault lines, such as those in San Francisco, Oakland, and San Jose, often face higher premiums.

- Home Age and Construction Type: Older homes or those constructed with materials less resistant to earthquakes may incur higher insurance costs.

- Deductibles: Earthquake insurance policies typically have high deductibles, ranging from 10% to 25% of the home’s insured value, meaning substantial out-of-pocket expenses before coverage begins.

Assessing the Value of Earthquake Insurance

Given the Bay Area’s seismic history and risk, earthquake insurance warrants serious consideration:

- High Probability of Significant Earthquakes: Experts estimate a 72% chance of a magnitude 6.7 or larger earthquake impacting the Bay Area by 2043.

- High Property Values: The substantial value of real estate in the region means that even minor damages can lead to considerable repair costs.

- Financial Preparedness: Without insurance, many may lack the necessary funds to rebuild or repair after a major quake.

- Mortgage Lender Recommendations: While not legally mandated, some lenders may strongly advise or require earthquake insurance for properties in high-risk zones.

Obtaining Earthquake Insurance in the Bay Area

Many residents secure earthquake insurance through the California Earthquake Authority (CEA), a non-profit organization offering policies via participating insurance companies. Additionally, private insurers may provide alternative options with varying terms and coverage.

The recent earthquake near Dublin underscores the Bay Area’s vulnerability to seismic events. While earthquake insurance represents an additional expense, it offers essential financial protection for those residing in this earthquake-prone region. Homeowners should evaluate their risk tolerance, property location, and financial capacity to recover from potential disasters when deciding on investing in earthquake insurance.

Video capture from NBC Bay Area

Leave a comment